net operating working capital turnover

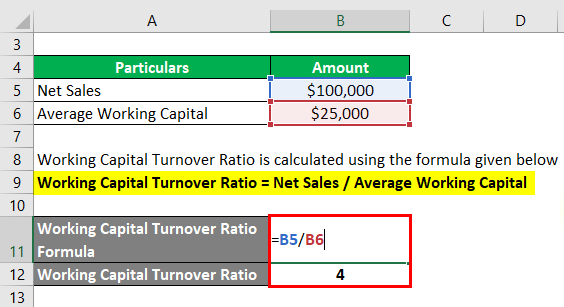

The working capital turnover is calculated by taking a companys net sales and dividing them by its working capital. Formula For Working Capital Turnover Ratio Working Capital Turnover Ratio Turnover Net Sales Working Capital.

Working Capital Turnover Ratio Different Examples With Advantages

At the very top of the working capital schedule reference sales and cost of goods sold from the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss.

. Working Capital Turnover Net Annual Sales Average Working Capital beginaligned textWorking Capital TurnoverfractextNet Annual Sales. The working capital turnover calculator helps in determining the efficient working of this by the management. Working Capital Turnover Ratio is the ratio of net sales to working capital.

The calculation of its working capital turnover ratio is. Net Sales or Turnover Gross Sales Discounts Credit Note Taxes. Here Total Sales 500000.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. Net Operating Working Capital Cash Accounts Receivable Inventories Accounts Payable. You can define net operating working capital or NOWC as a financial measure or ratio of a companys ability to assume its operating liabilities using its operational assets The formula for NOWC is to add cash account receivable and inventory to one another and deduct from that account payable and accrued expenses.

The working capital turnover ratio is calculated as follows. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result. Current Assets 10000 5000 25000 20000 60000.

Working Capital Current Assets Current Liabilities or COGS Net Sales Gross Profit or Opening Stock Purchases Closing Stock Example. Working Capital Turnover Net Sales Net Working Capital NWC The sales of a business are reported on its income statement which tracks activity over a period of time. In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses.

Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the business and scale. Capital turnover also called equity turnover Equity. 60 Working capital turnover ratio.

Net Operating Working Capital Current Operating Assets Current Operating. How to Calculate the Working Capital Turnover Ratio. Net annual sales divided by the average amount of working capital during the same year.

The Formula for Working Capital Turnover Is. Working capital Turnover ratio Net Sales Working Capital. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000.

Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. Setting up a Net Working Capital Schedule. Sales Return 80000.

The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. Calculate working capital turnover ratio from the following data. And Net Sales Total Sales Sales Return.

Net Sales Sales Returns. Working Capital Turnover 8 billion 148 billion 125 billion 2 The working capital turnover ratio for 2018 was 58 or 58 for every 100 dollar of sales. NWC Turnover Ratio Formula.

It measures how efficiently a business turns its working capital into increase sales. Operating working capital focuses more on day-to-day operations whereas net working capital looks at all assets and liabilities. The working capital turnover is a ratio to quantify the proportion of net sales to working capital.

Working capital turnover of a business is the net sales of the business. Capital turnover is the measure that indicates an organizations efficiency about the utilization of capital employed in the business and it is calculated as a ratio of total annual turnover divided by the total amount of stockholders equity also known as net worth and the higher the ratio the better is the utilization of capital employed. Example of Working Capital Turnover Ratio.

For 2018 total returns equaled just over 8 billion. To illustrate the working capital turnover ratio lets assume that a companys net sales for the most recent year were 2400000 and its average amount of working capital during the. Where Net Sales Total Sales Sales Return.

Now working capital Current assets Current liabilities 100000 40000 60000. Once you understand what working capital and turnover mean it will be easy for you to understand the purpose of the ideal working. Working capital turnover Net annual sales Working capital.

Formula to Calculate Working Capital Turnover Ratio. Working Capital is calculated by subtracting total liabilities for total assets. Operating current assets are assets that are a needed to support the business operations and b expected to be.

Working Capital Turnover Ratio helps determine how efficiently the company is using its working capital current assets current liabilities in the business and is calculated by dividing the companys net sales during the period by the average working capital during the same period. Putting the values in the formula of working capital turnover ratio we get. Net working capital is more comprehensive because it represents the cash and other current assets a company has to invest in operating and.

Since net sales cannot be negative the turnover ratio can turn negative when a. Net sales Beginning working capital Ending working capital 2 Example of the Working Capital Turnover Ratio. The formula for calculating the net working capital NWC divides a companys net sales ie.

Working capital Turnover ratio Net Sales Working Capital. Turnover by its net working capital NWC. In principle the working capital turnover or net working capital turnover measures how much money a company required to run the business compared to its ability to.

Generally a higher ratio is better and suggests that the company does not. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2. Turnover is an important factor when calculating various ratios.

Below are the steps an analyst would take to forecast NWC using a schedule in Excel. Working Capital Turnover. Operating working capital is a narrower measure than net working capital.

It is a measure to define how well the company has made investment in the companys working capital for funding the daily operations and sales. The Formula for Working Capital Turnover Is. Therefore Net Sales 500000 80000 420000.

What Is Working Capital Turnover.

Working Capital Turnover Ratio Double Entry Bookkeeping

Working Capital Formula And Calculation Exercise Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula And Calculator

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Different Examples With Advantages

What Is Net Working Capital Daily Business

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Net Operating Working Capital What It Is And How To Calculate It

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula And Calculator